How we got here

Methodology

Coordinate the allocation of Private Activity Bonds through a regional agreement

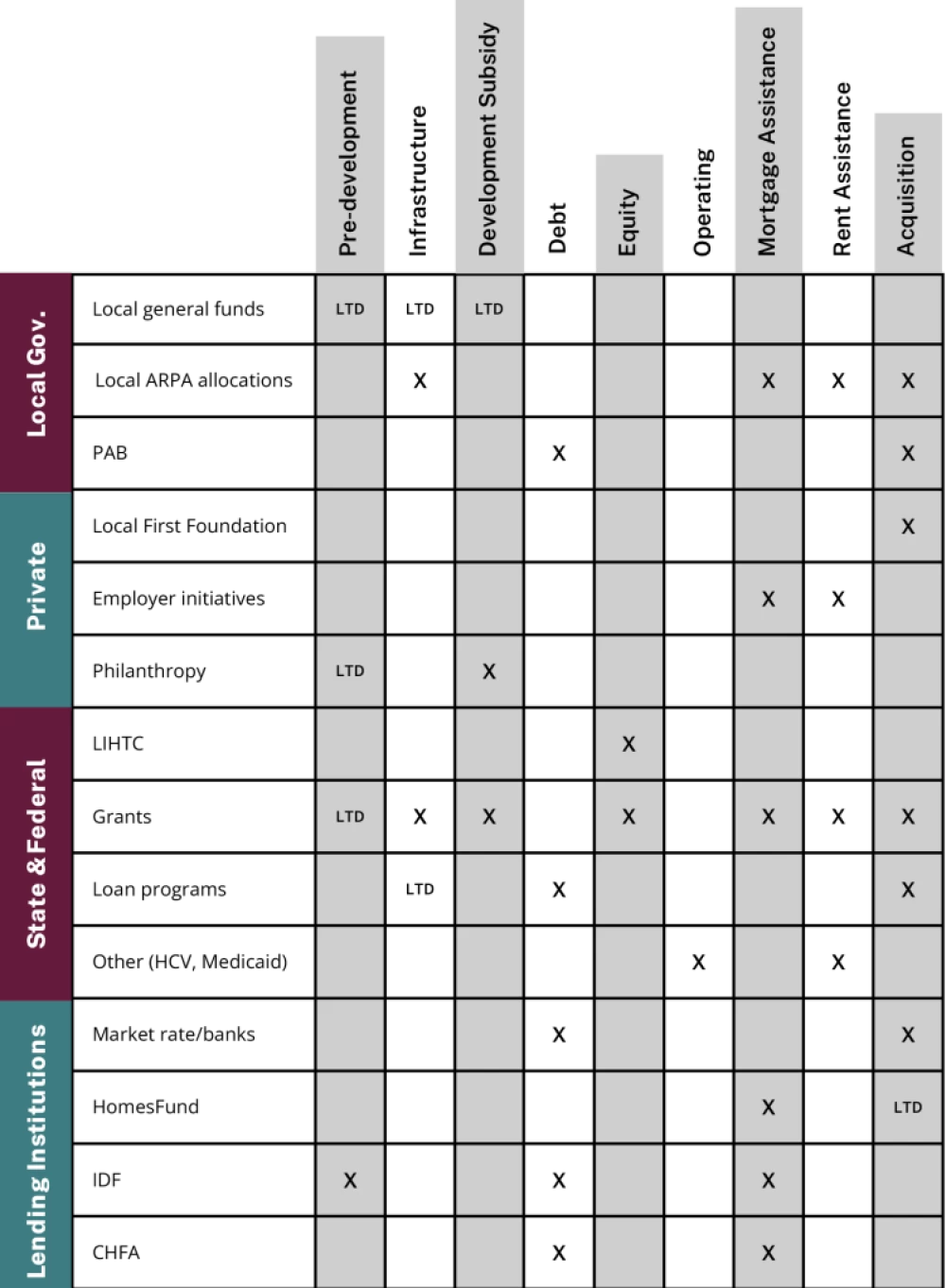

Private Activity Bonds (PABs) are a public funding resource that is allocated to La Plata County and the City of Durango by the State of Colorado. The Colorado Division of Housing (DOH) also allocates separate PABs in a statewide pool. This resource alone is not adequate to fund projects but combined with the 4% Low Income Housing Tax Credit (LIHTC), it is a powerful tool to support larger affordable rental developments. The PAB allocation process for housing is managed by the Colorado Housing and Finance Authority (CHFA) and the Colorado Division of Housing (DOH). Local governments have the choice to allocate PABs to a local project or assign them back to CHFA to support affordable housing statewide.

The community has a track record of coordinating PAB allocation with the first housing project in 2019; the use of PAB allocations to preserve Tamarin Square Apartments (68 units of low-income senior and disabled housing) was a significant win for the local community. In 2022, the community again coordinated PAB allocation for use by TWG development in its efforts to convert the Best Western into affordable housing through a PAB/4% LIHTC funding model. The team is hopeful that there will be more opportunities to use this limited resource to either preserve or promote rental housing projects, and also expects pressure from out-of area developers and projects who have the ability to ask local governments to transfer their PAB cap to projects on the Front Range in Colorado. The consulting team recommends a powerful yet simple action that the City of Durango and La Plata County coordinate their allocations annually by using a shared process for inviting applications from project developers, and jointly evaluating and selecting projects to increase resource leverage for both entities. As part of the appendix to this report the team is providing a draft template for coordinating PABs for future years.

Coordinate countywide support of housing projects applying for tax credits, prioritizing those with community sponsors and those which assist in recruiting developers for specific projects.

Low Income Housing Tax Credits are the most widely used subsidy for affordable housing rental development in the country. Annually, this tool produces thousands of units of affordable housing in Colorado. Every year, the federal government allocates credits to the state to distribute through a competitive process to projects. These projects are typically between 30 and 150 units and must restrict rents to certain income levels for 30-40 years, depending on their financial model. The 9% LIHTC model provides anywhere from 50% to 75% of the required equity for a project. Development partners are allowed between 10% and 15% of development costs as a fee for providing the units. Communities benefit from well designed, affordable rental communities and investors receive a double-digit federal tax write-off. Because of these enormous benefits, LIHTC is a competitive program and is oversubscribed 4:1 in Colorado. The good news is communities have some control over the allocation process because CHFA, the allocating agency, gives significant weight to support from local communities and local governments for specific projects.

In our interviews for this report, we heard interest in using the 9% credit from several key players, which led us to recommend that local communities coordinate a development pipeline for the LIHTC program. Because we are in a rural region, we can expect to receive one 9% allocation every two to three years. There are strict requirements about local market demand, and with the LIHTC program being in high demand, many of the resources are allocated to the large population centers in Colorado. By coordinating a local LIHTC pipeline, the community will help prevent competition among local projects, can clearly support a project (giving it a competitive advantage), and will inevitably end up with higher quality projects and more community benefits for the projects that are funded.

Enact uniform local government policies for workforce housing fee waivers.

In our interviews, we learned that many local governments were providing some kind of fee waiver or fee offset for below-market or affordable housing. This has very positive impacts, and our recommendation suggests building on the public goodwill generated by this activity and improving upon this practice in multiple ways:

- Formalize the practice at the local level. Which fee offsets are available for which types of units, and what is expected in return for that waiver or fee offset? Bayfield has some very straightforward fee waiver practices in place that could provide a good template for other communities.

- Budget for fee-offset program costs based on the projected development pipelines or funding available.

- Fee offsets are critical to projects applying for competitive funding like LIHTC allocations; having a set program for waivers or offsets will make local applications much more competitive and will create a smoother process for the development team.

Fee waivers and/or offsets have been funded in a variety of ways in other communities: (1) by establishing a local funding source versus reliance on local government’s general fund, (2) through state grants like CDBG, and (3) through subsidies provided by local governments’ infrastructure funds. To simplify paperwork and add capacity for all local governments, the Regional Housing Alliance might consider coordinating funding applications to the Department of Local Affairs for funding for infrastructure and fee waivers.

Establish a Housing Catalyst Fund to support non-tax credit rental projects with predevelopment costs.

Predevelopment funding is the first funding for any project and also the riskiest funding. Predevelopment funding programs offer financing to cover a variety of development expenses—sometimes referred to as “soft costs”—incurred while determining the feasibility of a particular project, such as costs of preliminary financial applications, legal fees, architectural and engineering fees, and other exploratory work. Obtaining financing for these costs is difficult in good economic times and impossible in challenging times. A number of state and local governments have developed predevelopment loan programs to cover these expenses, thereby facilitating and expanding development of below-market housing. Our team has spent two decades doing predevelopment work and seeking predevelopment funding for projects throughout the Southwest. Our experience is that when a local community, agency or local government provides predevelopment resources, they have more influence over the project’s design and most importantly, can help a “stuck” project move forward and determine feasibility. One of the “best practice” models for predevelopment is the Section 4 program, a federal initiative under the Department of Housing and Urban Development. Section 4 funds are awarded competitively across the country to help projects with early feasibility and due diligence work. The challenge with Section 4 is that it is underfunded and only five to seven projects in Colorado receive funding each year. Section 4 was a primary funding source in the early days of developing the Regional Housing Alliance and the subsequent creation of the HomesFund.

The consultant team recommends that the Economic Development Alliance launch a Housing Catalyst Fund (Catalyst Fund). This would adopt the best practices of the Section 4 program while providing more resources to launch several projects throughout the county. The team recommends the following structure for the Catalyst Fund:

The Catalyst Fund would be administered by the Economic Development Alliance team and its consultants. The Catalyst Fund would be directed by a steering committee of representatives from the four governments (staff or elected), RHA, a local employer, a local nonprofit, a local bank, and a member of the Economic Development Alliance board. The Catalyst Fund will launch with a focus on rental housing, but could be used for any housing projects in the near future.

This steering committee would approve funding guidelines, review applications to the fund, and approve funding allocations. It is anticipated that this committee would meet monthly to launch this fund by July 2022 and then would shift to meeting every other month.

The team recommends that the Catalyst Fund be capitalized with up to $1,000,000 in the next 12 months with the following funding sources: local government contributions (ARPA), Funds from private sector (Local First Foundation and/or local employers), and a possible grant from DOH (requirements forthcoming this summer).

This fund would provide at least three levels of support for potential projects:

- Predevelopment grants of up to $25,000: These grants could be used to cover the costs of third-party studies, hire a development consultant, or hire a technical consultant to assist with early feasibility assessments. Eligible applicants include local nonprofits, private developers, and local governments. These smaller grants are targeted toward projects of less than 30 units, nonprofit partners, and/or rural projects.

- Predevelopment grants of up to $75,000: These grants could be used to cover the same costs as above, but projects must be larger in scale (31 units or greater).

- Predevelopment grants up to $150,000: Given this level of funding, the applications would be more competitive and would require a higher threshold for demonstrating a readiness to proceed. Project underwriting would be provided by the Economic Development Alliance consulting team. The goal of these grants is to catalyze large- scale projects over the next several years.

The Catalyst Fund committee would act as an advisory committee and would confirm each program application and assist with application review and overall program development. With this mix of funding supports it is anticipated that the Catalyst Fund could support five to seven projects annually. Currently, the Economic Development Alliance has secured $120,000 for this initiative and anticipates launching the committee in June of 2022 with a first funding opportunity in July. This program will not only catalyze projects but will help the county to track projects and the development pipeline, which will inform additional housing opportunities as well as notify the community of projects that are stymied by various constraints.

Support Fort Lewis College’s efforts to develop below-market rental housing for staff and faculty in the next 18 to 24 months on campus land.

In 2021 Fort Lewis College launched an employer housing initiative with three primary strategies. One of those strategies is to explore a rental housing project on campus for faculty and staff. This project launches in May of 2022 and will require support and local funding. This project will target 80%-120% of area median income to meet a specific gap in rental affordable to this income bracket. The project will have a preference for FLC staff and faculty but will also serve employees from 9R and the broader community. As the first employer sponsored rental project; this will serve as a pilot that can inform the community on how to approach these projects and possibly replicate with additional employers in the near future.

The rest of this article is continued on page 22 of the Workforce Housing Strategy PDF document.